DeFi’s next chapter will be written by those who can bridge the gap between institutional-grade infrastructure and a genuinely user-friendly experience, fulfilling the original promise of open, borderless finance for everyone.

The Digital Frontier: A Report Card on Cryptocurrency and Tokenization

The world of Decentralized Finance (DeFi), built upon the twin pillars of cryptocurrency and asset tokenization, is no longer a fringe movement; it is an economic revolution in progress. It promises a world of borderless, permissionless, and transparent financial services, an open network accessible to anyone with an internet connection. This “Report Card” provides a snapshot of the current landscape, identifying the major players and currencies, and examining who is being left behind, and why.

Grade: A- (Achieving Institutional Maturity with Lingering Access Issues)

The industry is excelling in technological innovation and institutional adoption, moving from speculative curiosity to a foundational layer of future finance. However, it is held back by persistent issues of complexity, regulatory uncertainty, and a failure to fully democratize access for the least financially literate.

(Note: Still, less than 7% of the world’s population has ownership of any form of cryptocurrency; see the footnote for a dissection of that 7%.1)

Part 1: The Honor Roll

The Major Players and Leading Assets

The major players in the crypto world fall into three distinct, yet increasingly interconnected, categories: foundational layer-one blockchains, stablecoin issuers, and institutional adopters driving Real-World Asset (RWA) tokenization.

A. Foundational Blockchains: The Internet of Value

These are the decentralized networks that host the entire DeFi ecosystem, providing security, settlement, and programmability —

(1) Player: Bitcoin / BTC

Primary Purpose: Digital Gold / Store of Value

Why it is Leading: First-Mover Advantage & Scarcity. Its finite supply (21 million coins) and unparalleled network security establish it as the benchmark decentralized asset. Recent approval of spot ETFs (electronically traded funds) in major markets solidifies its status as a mature institutional asset.

(2) Player: Ethereum / ETH

Primary Purpose: Decentralized Computing / Smart Contracts

Why it is Leading: Ecosystem Dominance. The first and largest platform for smart contracts, it is the backbone of most DeFi and NFT activity. The transition to Proof-of-Stake improved energy efficiency and enhanced Ethereum’s credentials for institutional use.

(3) Player: Solana / SOL

Primary Purpose: High-Throughput Network

Why it is Leading: Scalability and Speed. Known for its rapid transaction speed and low fees, Solana has emerged as a top competitor, attracting significant development for decentralized applications (dApps) and becoming a hub for high-volume consumer applications.

Why they are leading: They have achieved critical network effects, robust security, and the essential utility required to power the decentralized economy. Bitcoin remains the secure store of value, while Ethereum and its competitors (like Solana) provide the programmable layer for innovation.

B. The Bridge Builders: Stablecoins and Tokenization Platforms

Tokenization — the process of representing a real-world asset (like a house, a share, or a treasury bill) as a digital token on a blockchain — is the new frontier. Stablecoins, the first widely adopted tokenized assets, remain essential.

(1) Player: Tether / Circle

Primary Purpose: Fiat-Pegged Stablecoins

Why is it Leading: Liquidity and Utility. They provide the essential, non-volatile settlement layer for the entire crypto ecosystem, allowing traders to move capital without exiting the blockchain. Their dominance reflects the market’s need for a stable digital dollar.

(2) Player: BlackRock / Ondo Finance (BUIDL / OUSG) — Tokenized Treasuries

Primary Purpose: Real-World Asset (RWA) Tokenization

Why is it Leading: Institutional Adoption. BlackRock’s entry with a tokenized fund (BUIDL) legitimizes the space. (Reportedly, up to $10 trillion of BlackRock assets are in the process of being tokenized.) Ondo Finance and similar platforms leverage this by offering on-chain access to high-yield U.S. Treasury products, bridging compliant TradFi assets with DeFi.

(3) Player: Chainlink / LINK

Primary Purpose: Decentralized Oracle Network

Why is it Leading: Data Integrity. Chainlink’s network provides secure, tamper-proof real-world data (e.g., asset prices, event outcomes) to smart contracts, making complex, real-world-connected DeFi applications and RWA tokenization possible.

Why they are leading: They are solving the crucial problem of volatility (stablecoins) or connecting the trillions of dollars in traditional finance to the blockchain (RWA tokenization), driving capital and regulatory clarity into the ecosystem.

Part II: Not Honor Roll

Who is Being Left Behind, and Why? (The Underperformers)

While the DeFi revolution is in full swing, certain groups and types of projects are struggling to keep pace, primarily due to issues of complexity, poor user experience, or a failure to meet modern market demands.

A. The General Public (The Mass Adoption Gap)

The promise of permissionless and inclusive finance has not yet fully materialized for the average person, especially the globally unbanked.

(1) Group Being Left Behind: Users Requiring Simple Interfaces

Why They Are Left Behind: Complexity and UX (user experience). The current state of self-custody (managing private keys), gas fees (transaction fees), and complex protocols (like staking or lending) is intimidating and prone to user error. A single mistake can lead to permanent loss of funds.

Consequence: Low Financial Literacy Barrier. DeFi remains primarily a tool for the crypto-literate, not the financially underserved, hindering true global adoption.

(2) Group Being Left Behind: The Unbanked and Vulnerable

Why They Are Left Behind: Digital Prerequisites. Widespread and affordable internet/smartphone access remains a prerequisite. Furthermore, high volatility in crypto assets poses existential risks to those living paycheck-to-paycheck, making them unsuitable for emergency savings or core financial stability.

Consequence: Unfulfilled Social Promise. DeFi has not yet provided a safe, simple, and stable financial utility to the world’s neediest populations.

The ‘Why’: Decentralization, by its nature, removes intermediaries, placing the full burden of security and operational complexity on the individual user — a responsibility most are not prepared for.

B. Outdated Blockchain Projects (The Technology Lag)

Older or less-innovative projects are being outpaced by superior technology and market forces.

(1) Player Being Left Behind: High-Fee / Low-Speed Blockchains

Why They Are Left Behind: Technological Debt. Blockchains with poor scalability, high transaction costs (gas fees), or slow finality times are unsuitable for high-frequency or micro-transaction applications.

Consequence: Migration to Competitors. Developers and users are migrating to faster, cheaper alternatives like Solana, Avalanche, and Layer 2 solutions on Ethereum, leaving the older chains with reduced utility and ecosystem growth.

(2) Player Being Left Behind: Unregulated, Low-Utility Tokens

Why They Are Left Behind: Regulatory Scrutiny & Lack of Utility. Many tokens created during previous market booms lacked a clear, sustainable business model or compliant framework. Regulators are increasingly scrutinizing assets not tied to clear consumer or institutional use cases.

Consequence: Market Irrelevance. Without utility in DeFi, tokenization, or a strong store-of-value narrative, many altcoins fade into irrelevance as institutional capital and regulatory focus shifts to compliant and high-utility assets.

The ‘Why’: The market is maturing and prioritizing efficiency, utility, and compliance. Projects that cannot offer all three are being superseded.

Conclusion: A Pivot to Financial Literacy and User Friendly Security Conscious Interfaces

The cryptocurrency and tokenization world’s 2024 Report Card shows a sector that has successfully pivoted from pure speculation to tangible utility. The major players—Bitcoin, Ethereum, stablecoins, and the institutional RWA platforms — are defined by their utility, security, and increasing compliance focus.

The challenge now is not proving the technology’s viability; it is achieving equitable and safe access. The groups being left behind are those without the technical literacy to safely navigate the complexity, or projects that fail to meet the market’s demand for high performance and regulatory adherence.

DeFi’s next chapter will be written by those who can bridge the gap between institutional-grade infrastructure and a genuinely user-friendly experience, fulfilling the original promise of open, borderless finance for everyone.

Appendix 1: The Cost of Complexity: Statistics on Digital and Financial Illiteracy

The following statistics and data points illustrate how a lack of technical literacy directly results in financial vulnerability, exclusion, and tangible losses for certain groups attempting to engage with complex digital systems, particularly decentralized finance (DeFi) and crypto-assets.

- Americans aged 60 and older reported losing approximately $2.84 billion to cryptocurrency-related scams in 2024. This demographic often lacks technical familiarity with concepts like private key management and blockchain finality, making them prime targets for confidence and technical support scams. (Source: FBI IC3, 2024)

- Younger adults (ages 18–59) were four times more likely than older adults (ages 60+) to report losing money to an investment scam, with the majority of these being bogus cryptocurrency opportunities. This shows that being a “digital native” does not equate to “scam immunity,” as a lack of critical digital literacy (the ability to evaluate credibility and resist “Fear of Missing Out” or FOMO) leads to losses in complex, unregulated spaces. (Source: FTC, 2021)

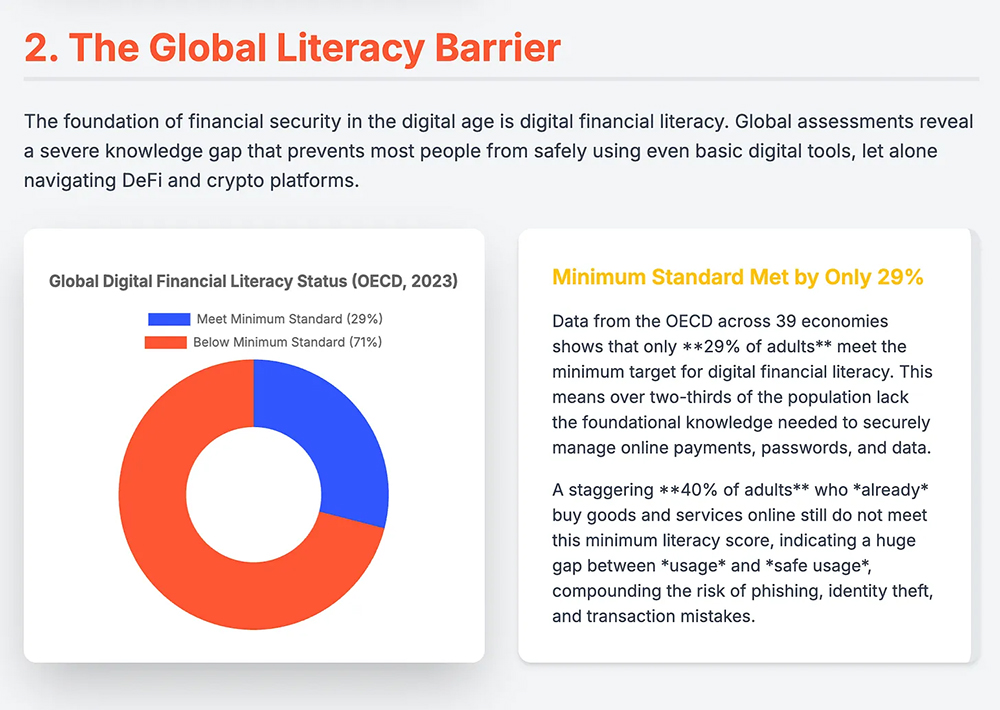

- Across the OECD (Organization for Economic Cooperation and Development) economies worldwide, only 29% of adults scored the minimum target for digital financial literacy. This vast gap means a majority, 71% of the adults in 39 of the world’s most educated and developed nations, lack even the basic foundational knowledge needed to securely use digital payments, much less navigate the complexities of DeFi. Thus, increasing the risk of security incidents, phishing, and financial mismanagement. (Source: OECD, 2023)

- 40% of adults who bought goods and services online in the OECD economies did not reach the minimum digital financial literacy score. This lack of essential security and functional knowledge actively hinders their ability to safely leverage digital tools, compounding inequalities and potentially leading to digital financial exclusion. (Source: ibid)

- Anecdotal Example: The Lost Seed Phrase: The most common anecdote representing the literacy gap is the irreversible loss of funds due to a lost or compromised seed phrase (private key). In centralized finance, a user can call a bank to recover a password. In DeFi, the technical complexity is unforgiving: there is no intermediary. For instance, a person unfamiliar with the difference between a secure hardware wallet and a simple screenshot of a seed phrase might lose their entire life savings after a device failure or a phishing attack, illustrating that technical literacy (knowing how the system fundamentally works) is now the primary barrier to accessing and safely maintaining wealth.

- Case Study: The “Pig Butchering” Scam: This increasingly common scam demonstrates how criminals exploit a lack of critical digital literacy. The scammer builds a long-term, often romantic, relationship with a target online. After gaining their trust, the scammer, posing as a successful investor, convinces the victim to invest in a “guaranteed” cryptocurrency opportunity on a professional-looking but fraudulent platform. The victim, lacking the technical skill to verify the platform’s legitimacy or understand the underlying blockchain transactions, transfers funds. The platform shows incredible “gains,” encouraging larger investments. Once the victim’s funds are exhausted or they try to withdraw, the scammer and the money disappear. This predatory tactic specifically targets those who may be digitally connected but lack the critical literacy to question sophisticated online manipulations, turning their trust into a devastating financial weapon against them.

Appendix 2: Glossary of Terms

- DAO: Decentralized Autonomous Organization. An organization represented by rules encoded as a transparent computer program (a Smart Contract), controlled by its members and not influenced by a central government or third party. Decisions are made through member voting.

- dApp: Decentralized Application. An application built using one or more Smart Contracts that runs on a decentralized network like a blockchain. They operate without a central authority.

- DeFi: Decentralized Finance. An alternative financial system built on blockchain technology that aims to remove intermediaries like banks and financial institutions from financial services.

- DEX: Decentralized Exchange. A peer-to-peer cryptocurrency exchange that allows users to trade digital assets directly without a centralized custodian or intermediary.

- RWA: Real-World Asset. A tangible or intangible asset that exists outside of the blockchain (e.g., real estate, commodities, art, bonds) that has been tokenized (represented as a digital token) on a blockchain.

- Smart Contract: A self-executing contract with the terms of the agreement directly written into code. The code and the agreements contained therein exist across a distributed, decentralized blockchain network, meaning they are immutable and tamper-proof.

- Tokenization: The process of converting the value and ownership rights of an asset (like an RWA) into a digital token on a blockchain.

- TVL: Total Value Locked. A key metric in DeFi representing the total value of cryptocurrency assets deposited, staked, or locked within a specific protocol or platform’s smart contracts. It is generally denominated in USD.

The Socio-Economic Spectrum of Crypto Users

- The 6.8% of users are highly diverse, but key socio-economic trends globally and in emerging markets reveal a specific profile —

Age: Skews younger, with the 25–34 age group being the largest cohort of users. This group is considered “digitally native,” but as the statistics in appendix 1 note, this doesn’t guarantee critical literacy, rather it more often leads to high exposure to investment scams (FOMO).

Gender: Predominantly male, with men accounting for about 61% of global crypto owners. This indicates a significant gender gap in early financial risk-taking and technical engagement, suggesting women may face greater digital financial exclusion.

Geography: Adoption is fastest in Emerging Markets, particularly in South America and Asia, with countries like the UAE and Singapore leading in ownership rates. In these regions, crypto is often driven less by speculation and more by necessity, serving as a hedge against local currency inflation and instability, or enabling remittances for unbanked populations. This shows crypto is not just for the wealthy, but a functional tool for those seeking alternative financial rails.

Income (U.S. Data): In the U.S., ownership is highest among upper-income households (for investing) but is also strong among low-income households (often used for transactions or remittances), compared to middle-income groups. This dichotomy highlights two segments: those using it as a speculative asset (higher income) and those using it as a fundamental financial tool to bypass traditional banking costs or limitations (lower income/unbanked). ↩︎